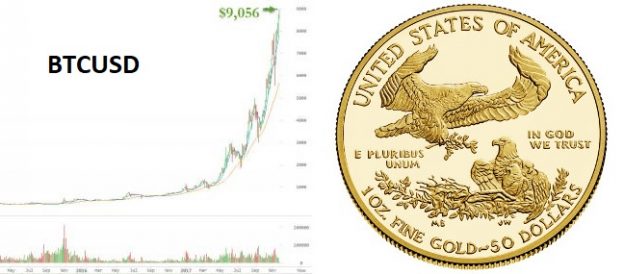

With the recent meteoric rise in the price of cryptocurrency such as bitcoin, preppers have been wondering whether to jump on the bandwagon with crypto, or stay the course with more traditional precious metals. Even long term precious metals champions in the liberty community such as “Ranting” Andy Hoffman and Bix Weir have been heard recently abandoning silver advocacy positions they have professed for years.

Let’s keep in mind cryptocurrency isn’t new. Bitcoin has been around for roughly five years. Why the sudden swing upwards in price, while precious metals have remained relatively flat? No one can be completely sure. From a prepper point of view, there are definitely some advantages and disadvantages that should be considered before buying into the craze.

Cryptocurrency Advantages

- Portability. It is definitely true that it is easier and safer in most instances to travel with cryptocurrency vs. precious metals. Going through an airport? As long as you arrive someplace with decent connectivity, you can pretty much take only your smartphone with you, and still have full access to your wealth. Bringing gold or silver in your bags is going to be met with all sort of difficulties: customs, security, risk of theft, etc.

- Exchangability. As more and more merchants accept crypto as payment, it will become easier and easier to purchase goods and services, including at a distance. This is ultimately the purpose of money – to serve as a medium of exchange. If you want to exchange silver for an item, you’ll need to purchase it in person, and far fewer sellers would consider accepting silver. Unfortunately many crypto holders are currently hoarding their coins expecting appreciation rather than exchanging it freely.

Cryptocurrency Disadvantages

- No Anonymity. Contrary to the popular myths, the majority of cryptos including bitcoin are anything but anonymous. In fact, every transaction is recorded publicly in the block chain. This provides a perfect trail back to an initial public funding event, such as purchasing via credit card or bank account at Coinbase. After that initial purchase, the subsequent purchases made with the crypto are completely trackable. The origin of those coins can be traced back to the initial USD purchase. Buy something in person in private with silver, and the transaction is between you, the seller, and the fencepost.

- Connectivity. There are some mechanisms that allow offline “cold” storage. However, if you want to actually transact in crypto, you’re going to need some connectivity at some point. This is not exactly convenient in any grid down scenario. In a short term

power/connectivity loss situation, cash is going to be king, not precious metals or crypto. If the duration of the downtime extends, cash will remain useful, but barter in items including precious metals will gain favor.

power/connectivity loss situation, cash is going to be king, not precious metals or crypto. If the duration of the downtime extends, cash will remain useful, but barter in items including precious metals will gain favor. - Taxes. You can bet the IRS is going to want their “fair share” of any ‘gains’ they perceive crypto as generating. They have issued guidance that crypto is not a currency, and therefore cost basis & profit must be tracked as with any commodity. With crypto’s infinite divisibility, this makes bookkeeping an absolute nightmare. Which 0.002352 BTC did you use to buy that cup of coffee at Starbucks? Think you won’t bother tracking it that closely? Remember the anonymity disadvantage – every transaction is completely traceable.

The Bottom Line

Crypto has several advantages and several disadvantages over precious metals. The largest concern however is timing – an absolutely parabolic rise in price since the beginning of the year. Not to pick on crypto specifically – history tells us that hockey stick upward moves in any asset only end one way: badly. We saw that a few years ago recently in silver when it rocketed to $50 only to plummet back to sub-$20. Before that, in 2007, we saw the same behavior in real estate, and before that in 2001 we saw the dot-com craze & crash in the stock market.

The prepper should tread cautiously with any crypto purchases while there is clearly a mania underway. Once the euphoria dies down and the price returns to a reasonable level, it does make sense to consider a portion of wealth diversified into crypto for its specific advantages. However that portion should be in addition to not as a replacement for the portion in precious metals. A sign to watch for is when people actually start using crypto as money rather than as a speculative play. At that point the real potential story of a fully decentralized digital currency may be realized, especially if the IRS grants more favorable tax treatment.

Crypto is useless in a grid down situation.